Perpetual Preferred Shares

Pays a fixed dividend as long as they are outstanding.

Has no maturity date.

Redeemable by the issuer, whereby issuer can call the preferred share on or after the call date.

Comparable to long term corporate bonds in duration (i.e. 30 years).

New bank perpetuals are comparable to medium term corporate bonds in duration (i.e. 10 years).

Floating Preferred Shares

Pays a quarterly or monthly floating dividend rate based on a reference rate (usually prime or 90 day government of Canada bond yield).

Some have a minimum dividend rate or floor.

For some, dividends can get raised or lowered on a monthly basis for floating shares that have a ratcheting mechanism. These changes in dividends are dependent on how the preferred shares are trading within a specified price band (range).

Fixed Reset Preferred Shares

Pays a fixed dividend until reset date, which is also the issuer's call date.

If the issue is not called, the holder has two options on every reset date:

Locking in a fixed dividend until the next reset date; and/or

Converting to a floating rate preferred share.

Holders have the option at each reset date of switching between a fixed reset preferred share and a floating rate preferred share.

Redeemable by the issuer, whereby issuer can call the preferred share on or after the call date.

Retractable Preferred Shares

Retractable by the holder whereby the holder can force the issuer to redeem the preferred shares at par value on a specific date.

Two types of retractable preferred shares:

Hard retractable preferred shares force the issuer to redeem the shares for cash; and

Soft retractable preferred shares give the issuer the option of repaying the par value in cash or in common shares.

Pays a fixed dividend.

Structured Preferred Shares

Structured preferred shares are synthetic preferred shares based on an underlying portfolio of common shares or a portfolio of financial instruments.

In the most basic structure, the portfolio allocates any capital appreciation to a capital share component and all dividend income to a preferred share.

Structured preferred shares are retractable on their own or in as a whole unit in some cases (preferred share plus a capital share on a special annual retraction date).

Structured preferred shares can be redeemed by the issuer when a capital share is retracted without a preferred share.

Structured preferred shares have a definitive maturity date.

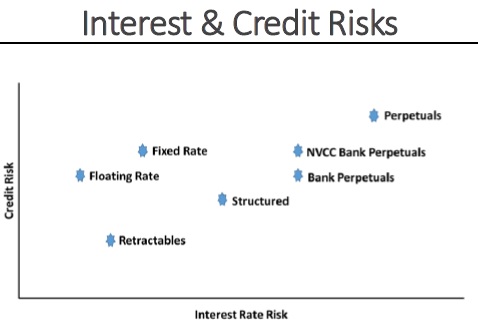

Interest and Credit Risk Spectrum